One Chart Shows Just How Messed Up America's College System Is

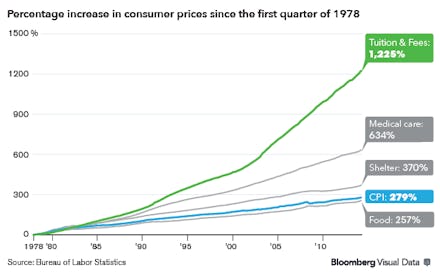

1,225%. That's how much the price of higher education has increased in the past four decades. No, that's not a typo, and yes, it's as scary as it sounds.

Image Credit: Bloomberg Visual Data

Since 1978, college tuition is rising at a rate faster than medical care and other basic costs like food, according to Bloomberg's data analysis. The horrifying stats just add to a slew of bad news permeating the dialogue about college tuition.

College enrollment is dropping. Students are accruing overwhelming amounts of debt from student loans, or are opting out of college completely. For the first time since the Great Recession, when university enrollment steadily rose, students are questioning whether hefty financial investment for college is really worth it, especially considering the uphill battle to secure work in this competitive job market after graduation.

This decline in overall affordability is forcing some students out of schools and creating daunting barriers to entry for others. In 2013, university enrollment in the United States dropped by roughly 300,000 students from the year before, according to U.S. News & World Report. While this may only represent a roughly 1.5% decrease, it's a telling sign of what might lie ahead.

As we face rising costs and declining enrollment, Bloomberg reports that Harvard Business School professor Clayton Christensen predicts that within the next 15 years, roughly 50% of America's 4,000 colleges will close. If the supply of higher education providers decreases, but the demand increases or stays the same, prices will only rise further.

Semi-good news: President Obama approved an executive order for the "pay as you earn" (PAYE) program in June. This "caps monthly student loan repayments at 10% of your income and allows any balance remaining after 20 years to be forgiven," reports the New York Times. Starting in 2015, students will have more manageable timetables and payment plans to lower student debt.

However, decreasing student debt woes is only part of the solution. Even with Obama's revised program banks, financial institutions and the government profit from student loans. As Yahoo News notes, "[T]hanks to new lending rules and historically low interest rates, the federal government is now getting a sizable piece of the [student loan] action." The Department of Education made an estimated $50.6 billion profit from student loans in 2013. That's hardly an incentive to change.

American universities need tuition reform, and they need it fast. There's no telling how long anyone will be able to afford them if things stay the way they are.