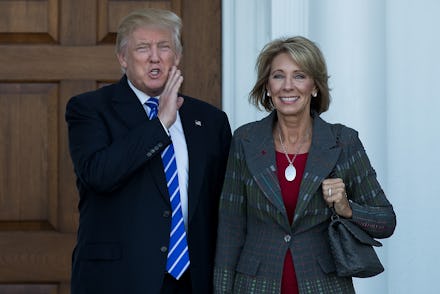

Donald Trump's new Cabinet members could save millions of dollars from this tax benefit

Why, exactly, would Exxon Mobil Corp. CEO Rex Tillerson, along with the other executives picked for Cabinet positions, accept the offer?

After all, there are tons of downsides, as one Fortune writer pointed out, including painful and sometimes embarrassing public hearings during the confirmation process — and hard-to-fire underlings if you do get appointed.

But there are potential upsides, too. Beyond the satisfaction of serving your country, there's at least one other big benefit: a fat tax perk.

Originally designed to incentivize people from the private sector to work for the public sector, some who leave big business to work on Capitol Hill are allowed to defer 15% capital gains tax on all assets sold — necessary in order to avoid conflicts of interest — until after they return to the private sector.

"A little-known provision of the tax code currently allows executive branch and judicial appointees to defer paying taxes on profits from assets they sell to comply with ethics rules," wrote Senators Sheldon Whitehouse (D-R.I.), Elizabeth Warren (D-Mass.) and Tammy Baldwin (D-Wisc.), who are trying to limit these benefits in anticipation of their exploitation, in a press release Thursday.

The provision in question can pay off enormously because you are converting high-risk assets — like stock in your company, which may or may not be in good financial shape — into low-risk assets, like government bonds. And you're getting what is effectively an interest-free loan on your tax bill, New York University tax law professor Lily Batchelder told Vice.

"The ability to defer paying tax on capital gains is a huge tax benefit," she said.

"It's similar to the benefit we give contributions to 401(k)s," Batchelder added. "Like 401(k)s, it means you don't have to pay tax on income when you receive it, but only when you withdraw the funds from the new investment, potentially decades in the future. But unlike 401(k)s, there is no limit on how much capital gains can be deferred in this case."

That is why Senators Whitehouse, Warren and Baldwin seek to cap the benefit to apply to a maximum of $1 million in gains.

Even without a deferral, the 15% tax on capital gains is already low compared to the average American federal income tax rate of 21%.

As the combined wealth of Trump's Cabinet nominees overtakes $15 billion, that capital gains tax deferral benefit for appointees could amount to a pretty penny.