At Some Point In Your Life, You'll Probably Be In Poverty

The news: While we often talk about income and class as fixed features of our lives, that's not totally accurate. This data from economists Mark Rank and Thomas Hirschl shows as many as 61% of Americans will be in the top 20% of earners for at least two consecutive years over the course of their lives.

Why? Sometimes we come into unexpected windfalls. Selling a house, receiving an inheritance, selling stock or scoring a well-paying but short-lived job can temporarily boost earnings, sometimes a hell of a lot. NPR Planet Money's Quoctrung Bui came up with these excellent infographics to help us visualize Rank and Hirschl's data, and the results might surprise you.

61% of U.S. households will break into the top 20% of incomes (roughly $111,000) for at least two consecutive years.

39% of U.S. households will break into the top 10% of incomes (roughly $153,000) for at least two consecutive years.

5% of U.S. households will break into the top 1% of incomes (roughly $360,000) for at least two consecutive years.

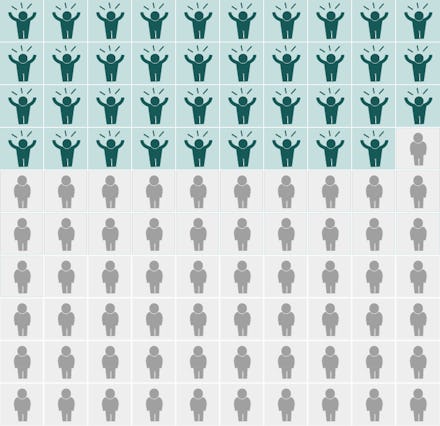

20% U.S. households will fall into poverty (roughly $23,850 for a family of four) for at least two consecutive years.

So what does this mean for you? The stark reality is that the nature of class mobility in America means a lot of your time will be spent much closer to the bottom of the nation's earners rather than the top. More research by Rank found that the percentage of the population that spends time in poverty is "exceedingly high" — 40% of Americans between the age of 25 and 60 will spend at least one year below the official poverty line ($23,492 for a family of four), and 54% will spend a year in poverty or near poverty (below 150% of the bottom line).

Here's what that looks like.

... If we add in related conditions like welfare use, near poverty and unemployment, four out of five Americans will encounter one or more of these events ... half of all American children will at some point during their childhood reside in a household that uses food stamps for a period of time.

Instead of consecutive years of extended poverty, many Americans will experience it sporadically at different times throughout their lives. Rank says the typical pattern is for workers to spend a year or two in poverty, work through it, then crash right back down to the bottom again. The large amount of class fluctuation suggests that disruptive and unexpected events like medical crises, divorce, layoffs or even a loss of working hours can seriously hurt a household's standing in the broader U.S. economy.

However, don't stretch this data farther than it goes. For one, the rich aren't defined by the size of their paycheck but by the size of their assets. Some of America's wealthy might not have big incomes — think young Brooklyn trust-funders or retirees soaking their bones in Florida — but could still be sitting pretty financially. And income is just income, not financial health. You could be blowing all that money on rims, Cubans and Hennessy, or maybe you're just soaked in debt up to your eyeballs. Or it could represent windfalls, like selling a house for a profit. Since those aren't sustained gains and most people end up using that money, which doesn't necessarily translate to a rise in class status.

Finally, it's worth noting that the richest Americans are absolutely dripping with money. That top 1% of earners controls 35.4% of the private wealth of the country, while the rest of the well-off control most of the rest. Check out this chart from William Donhoff:

In two recent studies, the Equality of Opportunity Project found that your ability to move up the economic ladder depends partially on where you live. They also found that the odds of reaching the top fifth from the bottom fifth nationally remain quite low.

Southerners, for example, are almost entirely out of luck.

"This map shows the average percentile rank of children who grow up in below median income families across areas of the U.S. (absolute upward mobility). Lighter colors represent areas where children from low-income families are more likely to move up in the income distribution."

The bottom line: The good news is that you're likely to get at least one windfall during your life. But the bad news is that you probably won't actually be more than temporarily well-off, and the chances that you enter the echelons of the extremely wealthy are next to nil.

So do the smart thing and save a good chunk of your cash for a rainy day. You might need it.