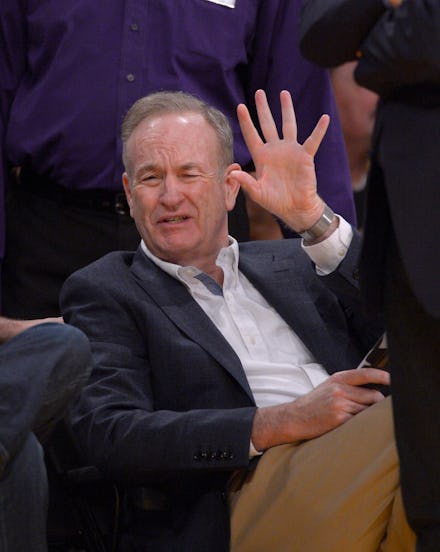

One Quote Shows How Little Bill O'Reilly Truly Understands About Average Americans

Finally, Fox News and Bill O'Reilly are actually talking about income inequality. It's one of the biggest problems in modern America, and the O'Reilly Factor is recognizing it.

Just take a look at one of the best talking points from Monday night's episode:

Hmm, that doesn't seem quite right? Just so we're clear, that line again is:

"Taxes are everywhere on affluent americans and business profits, but for the rest of Americans things aren't so bad."

The arguably backwards assertion followed a litany of statistics aimed at showing how the poor hardworking rich have been breaking their backs under President Barack Obama and suffering under a regime of a proposed "442 tax increases." Yep, those poor, poor super rich are really struggling.

True to form, the fundamental message here was misleading. O'Reilly continued his argument:

"So you can see that taxes are through the roof on affluent Americans and business profits. But for the rest of Americans, things are not so bad. The bottom 60% of wage-earners pay just 2.7% of federal income taxes. The bottom 40% actually get money from the feds; they receive payments called earned-income tax credits."

While O'Reilly claimed that Americans making over $400,000 a year need to pay almost 40% of their income to taxes, the reality is often different. With arsenals of lawyers, America's super-rich have many tools at their disposal to reduce their effective tax rates. Former Republican presidential candidate and charter member of the U.S. 1% Mitt Romney only paid an effective tax rate of 14% in 2011.

Warren Buffet, one of the world's wealthiest people, had long said he is taxed at a lower rate than his secretary.

An analysis from Corporation for Enterprise Development published in Mother Jones found that taxation in America at the state level was "regressive," meaning that it took a disproportionate share from the poor. In every state, the report found that the top 1% paid a lower effective tax rate than the bottom 20%. In many cases, the rate was four to five times higher.

O'Reilly is right about one thing, though — making the wealthy pay more won't solve the problem of income inequality in America. Stagnant wages and a shrinking middle class are multifaceted problems that won't be fixed with a cure-all. Still, with a level of income inequality equivalent to the Gilded Age, making the rich pay their fair share is something that cannot be ignored any longer.

Updated: April 21, 2015 12:00 p.m.