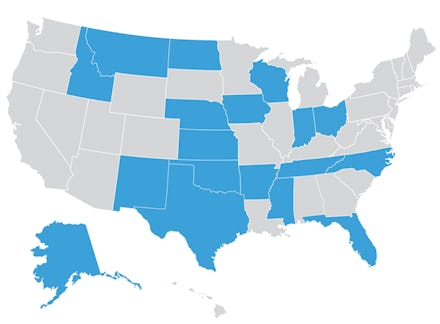

18 States Cut Taxes in 2013 — Was Your State One Of Them?

Death and taxes are, of course, the only two constants in life. But these 18 states are trying to make life a little easier for their residents — cutting billions of dollars in taxes for 2014 and into the future.

The conservative American Legislative Exchange Council released the data this week in their State Tax Cut Roundup. According to ALEC, 18 states passed legislation in 2013 cutting taxes for 2014 and beyond.

Of the 18 states, 14 are controlled by Republicans.

The types of tax cuts passed by state legislatures in 2013 vary. Among the most popular forms of tax relief were cuts to personal income tax, which accounted for nearly a quarter of the cuts across the 18 states, and cuts to corporate income taxes came to about an eighth.

Source: ALEC, State Tax Cut Roundup

“With the federal government locked in seemingly endless gridlock, it is up to the states to jumpstart their own economies,” concludes the ALEC report.

Just how state economies will be impacted, however, depends on the types of cuts made, and by how much. The folks over at the Washington Post’s GovBeat have put together a nifty list of the states that cut taxes in 2013, what exactly they cut, and the amount of estimated tax relief. GovBeat notes that the estimated relief could come anywhere from 1 to 5 years after the cuts, depending on the type of package passed by state legislatures. Here’s the list, in order of size of tax cut package.

1. Iowa

Property tax, personal income tax

Relief: $4.4 billion

2. Kansas

Personal income tax, sales tax

Relief: $3.8 billion

3. Ohio

Personal income tax, small business tax

Relief: $2.7 billion

4. Indiana

Personal income tax, corporate income tax, inheritance tax

Relief: $1.1 billion

5. North Dakota

Property Tax

Relief: $1.1 billion

6. Texas

Margins tax

Relief: $1 billion

7. Alaska

Oil tax

Relief: $750 million

8. Wisconsin

Personal income tax

Relief: $650 million

9. North Carolina

Personal income tax, corporate income tax, inheritance tax, others

Relief: $500 million

10. Oklahoma

Personal income tax

Relief: $237 million

11. Tennessee

Sales tax

Relief: $164 million

12. Arkansas

Personal income tax

Relief: $160 million

13. Florida

Manufacturing sales and use tax

Relief: $115 million

14. Montana

Personal property tax

Relief: $100 million

15. New Mexico

Corporate income tax

Relief: $55 million

16. Idaho

Personal property tax

Relief: $20 million

17. Nebraska

AMT, capital gains tax

Relief: $7.8 million

18. Mississippi

Energy sales tax

Relief: $6 million