The government is just as skeptical of Facebook’s cryptocurrency as you are

Mark your calendar, it's official: Facebook's cryptocurrency Libra will launch in 2020 for Facebook Messenger and WhatsApp users located worldwide. This digital currency aims to be a stable alternative to Bitcoin while providing financial services to developing nations that lack access to traditional banks. Facebook plans to make Libra an easy way to hold and exchange money without requiring a bank account.

To do this, Libra will rely on a system called 'blockchain.' Blockchain is, in extremely simple terms, a way to make transactions without relying on banks. For example, it can take your digital purchase, record the information into a 'block,' and then set it in a ledger of sorts — a 'chain' of similar blocks with information. From here, the seller can verify the transaction and make the exchange.

It's a direct way of exchanging goods and services from seller to buyer without communicating through a third-party (like banks). This means there's no transaction costs, no accidental double-charges whenever a store's credit card machine 'hiccups,' no minimum savings requirements, and no need for personal documentation that some people might not have. A blockchain system strives to be as close to privately exchanging cash from buyer to seller as possible.

By building Libra's foundation on a blockchain ecosystem, Facebook hopes to offer users a secure and cost-effective way to manage finances. According to Investopedia, hacking a blockchain requires an extensive amount of work and computing power that renders the effort moot for most criminals. Facebook believes this will make Libra a more secure option than some centralized banks, especially ones with holes and weaknesses in their security.

However, this does not necessarily make cryptocurrencies the safest form of money. Reuters reported a surge of thefts from cryptocurrency exchanges during the first half of 2018, with almost $761 million in total stolen. The crimes have only become worse during the first quarter of 2019, especially as other cryptocurrency companies jump into the field, and regulators and law enforcement are still struggling to figure out what to do about it.

That's not all there is to worry about. Libra, as a cryptocurrency, can sound very convenient, but it can also have an incredible weakness.

The 'real world' value of cryptocurrencies is up for debate

Currently existing cryptocurrencies, like the infamous Bitcoin, have high volatility – meaning it's a risky bet because its worth rises and falls far too often for a user to feel secure. Bitcoin, for example, has had its value drop over $8,000 within one day. People have gained and lost $1 million within a year on Bitcoin, as reported by The Guardian. Furthermore, the instability of cryptocurrencies is so common by now that famed billionaire Warren Buffett has warned investors against putting too much money into them. He explained his stance in an interview with Yahoo! Finance last year, saying, "[I]f you buy something like bitcoin or some cryptocurrency, you don’t really have anything that has produced anything."

In other words, most cryptocurrencies have no intrinsic or real world value. This is one of the reasons the volatility is so high. The value of something like Bitcoin only exists because people are buying and selling it, critics warn. There's no regulation or foundation for its price. Throwing money at cryptocurrencies, Buffet stated, is just "hoping the next guy pays more."

Facebook is clearly trying to avoid this with Libra. According to the Libra white paper — a detailed report about the features of a product or service — the currency will be supported by an actual reserve of funds and assets called the Libra reserve, in order to give it stability and a real-world value. According to the company's plans, Libra will work to keep this reserve of assets maintained through safe, long-term investments.

It sounds solid on paper, but whether it will succeed in practice is difficult to predict. After 10 years, Bitcoin arguably still has little to no intrinsic value. Whether Libra can succeed where Bitcoin hasn't is a reasonable question.

Additionally, looking past cryptocurrency, there is also the Facebook problem.

Facebook still has accountability issues

Without a doubt, Facebook has received enormous scrutiny since their announcement on Libra. U.S. House Financial Services Committee Chairwoman Maxine Waters has already called for Facebook to stop Libra's development until a committee can review its plans. She expressed grave concern over Libra due to Facebook's repeated offenses in mishandling user data.

"I am requesting that Facebook agree to a moratorium on any movement forward on developing a cryptocurrency," she said in a statement to Reuters, "until Congress and regulators have the opportunity to examine these issues and take action."

For their part, Facebook seems to have predicted and prepared for this level of attention beforehand. The Libra white papers include a section that explains the company's intent to keep Libra accountable and decentralized. Facebook has teamed up with 28 other companies and organizations, including non-profits, to become the founding members of the not-for-profit Libra Association. The list of founding members includes companies such as MasterCard, Visa, PayPal, eBay, Spotify, and Mercy Corps, and each of these members plan to take part in regulating, developing, and securing the network for users. Although Facebook is also a founding member of this association, the company plans to take a step back after the launch to become one of many members with shared responsibility and power. Eventually, the group hopes to grow to approximately 100 members.

This isn't comforting enough for many critics. "We cannot allow Facebook to run a risky new cryptocurrency out of a Swiss bank account without oversight," said Senator Sherrod Brown in a statement to Reuters. "Facebook is already too big and too powerful, and it has used that power to exploit users’ data without protecting their privacy."

International regulators have also called for more scrutiny and laws to govern digital currency. Bruno Le Maire, France's Finance Minister, believes Libra's development is a sign that tech companies are becoming too big. In an interview with Europe 1 Radio, he stated, "This instrument for transactions will allow Facebook to collect millions and millions of data, which strengthens my conviction that there is a need to regulate the digital giants," Reuters reported.

On the other hand, the governor of the Bank of England, Mark Carney, has expressed an "open mind" about the practical usefulness and potential for Libra. According to the Financial Times, he noted that "payments systems around the world were highly unequal" and pointed out how some countries have "free and instant tools to move money" while others are stuck with "slow and expensive" financial systems. Still, despite the potential positives, he stressed that Libra will be heavily scrutinized by lawmakers.

A spokesperson from Facebook told The Verge that the company is willing to explain the company's plans before a committee — and they may have their first chance in July when the Senate Committee on Banking, Housing and Urban Affairs plans to hold a hearing on the new currency.

Moving forward with Libra

Without a doubt, Facebook and the Libra Association face a challenging battle in earning the trust of potential users. And government entities all over the world must face the reality that cryptocurrencies are not a passing fad — they must learn and plan for future regulation. Otherwise, as they often do, regulations will lag behind technological advances and the public will be left to trust enormous companies to self-regulate without putting profits first.

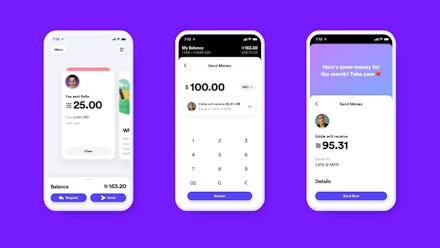

As another part of countering suspicions, Facebook continued to address the privacy issues while announcing its new subsidiary, Calibra. According to the company, Calibra is a digital wallet that "will let you send Libra to almost anyone with a smartphone, as easily and instantly as you might send a text message and at low to no cost." This can include a range of uses from making purchases to paying bills and transit fees. During the introduction, Facebook acknowledged its privacy issues and reassured users that the "Calibra [app] will not share account information or financial data with Facebook or any third party without customer consent." Supposedly, this means "customers’ account information and financial data will not be used to improve ad targeting on the Facebook family of products."

At this time, users only have Facebook's word that it won't happen. Although government oversight may put up barriers to Libra's launch, the legislative process is notoriously slow and it might not be fast enough to completely prevent Libra's release. And, while frustrating for some, the concept of Libra can be attractive enough to garner support from others. Libra could genuinely help the 1.7 billion adults who don't have banking accounts in the world. Many of these individuals are from developing countries with access to internet and smartphones, but don't live near banks or are in countries that run on a limited, cash-based system. According to The World Bank, accessibility to financial systems creates financial security, entrepreneurial opportunities to poorer communities, and empowerment to marginalized groups. Being able to tap into a financial system is critical for sustainable development.

At the same time, privacy and security concerns are still an enormous issue. Time will tell if Facebook's attempt to make a global currency will become successful. Libra is planned to hit the market within the first half of 2020, if government regulators don't hit Libra first.