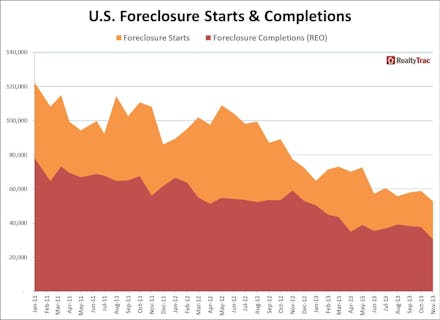

This Chart Shows That the Economy Really is Recovering

Some really good news: According to a Thursday report by RealtyTrac, an online marketplace for foreclosed and defaulted properties, American foreclosures are at the lowest levels since December 2005, as fewer and fewer people are losing their homes.

In November, 52,826 properties in the United States entered the foreclosure process, 15% less than in October, 32% less than the year before, and well below the 300,000-plus foreclosures a month that were seen at the height of the financial crisis. The decrease is a positive sign that the housing crisis is ending, even though not all states are out of the woods just yet.

This heartening chart from the report shows the steady decrease in both new foreclosures and foreclosure completions since the beginning of 2011.

Source: RealtyTrac

The background: Between greater scrutiny by banks and rising interest rates, home sales have been sluggish for much of the year, and homelessness in some areas of the country is on the rise. However, part of the sluggishness is the result of the drop in distressed sales cited by RealtyTrac's report. The change is likely the result of cautious loan practices and a drop in predatory lending, as well as gains in the job and financial markets that have made it easier for people to pay off their mortgages.

That said, the drop in foreclosures, like the overall economic recovery, has been uneven, as can be seen in this map showing state-by-state foreclosure rates.

Source: RealtyTrac

According to the report, Florida has the highest foreclosure rate in the nation, at one in every 392 housing units; for comparison, the national average is one in every 1,155 homes. The Sunshine State also boasts eight of the top 10 metropolitan areas for foreclosures. Delaware — where foreclosures are actually on the rise — Maryland, South Carolina, Illinois, and Ohio are also lagging behind.

The takeaway: The fact that fewer people are losing their homes is certainly good news, but it's equally encouraging to see better banking practices and tighter regulations begin to pay off. Hopefully, the decrease in foreclosures and an increase in the construction of new homes will also take some of the pressure off of the rental market, and make more housing available for low-income individuals.

Interestingly, increasing employment among young adults aged 25 to 34 is seen as the key to growing the housing market from here on in as, with any luck, increasing numbers of millennials are able to move out of their parents' homes, and maybe, someday, even afford homes of their own.